It is the sellers responsibility to verify that the certificate holders building materials exemption certificate number is valid and active. Must be for commercial manufacturing or industrial construction and not for residential.

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Instructions Project Information Contractor Information Cost Estimates Please complete a separate Form A for each separate contractor sub-contractor or organization that wishes to purchase eligible project materials with a.

Illinois building materials exemption certification lumber. What is eligible for a Building Materials Sales Tax Exemption Certificate. A contractor or other entity seeking a certificate must apply though the Zone Administrator of the zone where the project is located or through the High Impact Business project manager. Under the Illinois Enterprise Zone Act businesses can deduct the gross receipts from qualified retail sales of building materials that will be incorporated into property located in enterprise zones.

Building materials exemptions are only available to those contractors or other entities with a certificate issued by the Illinois Department of Revenue. ILMDA is a 132-year old association that serves the best interests of owners and operators of the independently owned retail lumber dealers in Illinois. A supplier claiming exemption hereunder shall have among his records a certification from the purchasing contractor stating that his purchases are for conversion into real estate under a contract with a church charity school or governmental body.

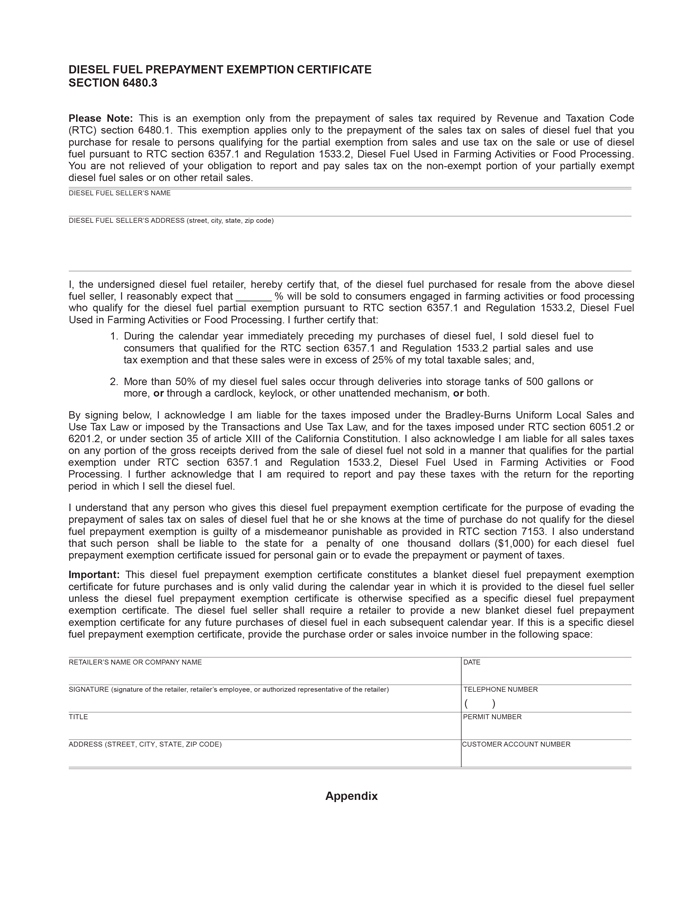

Section 1301951 Sales of Building Materials Incorporated into Real Estate within Enterprise Zones a An exemption from Illinois Retailers Occupation Tax liability exists for gross receipts from qualified sales of building materials that will be incorporated into real estate located in an enterprise zone established by a county or municipality under the Illinois Enterprise Zone Act by. Section qualified sale means a sale of building materials that will be incorporated into the Illiana Expressway for which a Certificate of Eligibility for Sales Tax Exemption Exemption Certificate has been issued by the Illinois Department of Transportation IDOT which has authority over the project. You must file this report if you were issued a Building Materials Exemption Certificate by the Illinois Department of Revenue to purchase tax exempt building materials for a high impact business for a business located in an Enterprise Zone or River Edge Redevelopment Zone or for a residence located within an Enterprise Zone.

Dept of Revenue the Illinois Supreme Court noted that it is obvious that building materials after they have been used in the construction of a house constitute real estate rather than personal property and that they are not transferred to the homeowner in any form as tangible personal property. Estimated cost of building materials are common building materials purchased in Illinois to be incorporated into the real property located in an EZ HVAC plumbing systems and fixtures lumber drywall and built-in appliances. You can confirm this by using the Verify Building Materials Exemption Certificates tool at our website at taxillinoisgov.

Who is eligible for a Building Materials Sales Tax Exemption Certificate. How do I apply for a Building Materials Sales Tax Exemption Certificate. Click on the Business Incentives and Building Materials Exemption Certification link for access to all tools and.

SALT Report 2345 The Illinois Department of Revenue issued a general information letter that discusses the enterprise zone sales and use tax exemption. You can confirm this by using the Verify Building Materials Exemption Certificates tool on our website at taxillinoisgov. The Sales Tax Exemption Certificate fee equal to 05 of total eligible building materials as reported on the Building Permit must be paid prior to receiving a Sales Tax Exemption Certificate.

Click Click on the Business Incentives and Building Materials Exemption Certification link for access to all tools and information regarding these. Material must be for commercial manufacturing or industrial construction and not for residential. Each construction contractor or subcontractor that purchases building materials to be incorporated into real estate in an Enterprise Zone by rehabilitation remodeling or new construction must complete this form.

Similarly in Lyon Sons Lumber and Manufacturing Co. Plumbing systems and components thereof such. However free-standing appliances or furniture are not eligible for sales tax exemption.

IL DOR Regulation Title 86 Part 130 Section 1302075d4. Common building materials such as lumber bricks cement windows doors insulation roofing materials and sheet metal can qualify for the exemption. When a certificate holder purchases tax exempt building materials the certificate holder must submit a signed statement to the retailer that contains the certificate number the zone the project and the qualified materials being purchased.

Building materials to be incorporated into real estate in an Enterprise Zone by rehabilitation remodeling or new construction. ILMDA represents some 90 retail companies and 65 associated companies that are suppliers of goods and services for our retail members in about 400 Illinois locations. Property owners must apply through the.

You must file a report if you were issued a Building Materials Exemption Certificate by the Illinois Department of Revenue IDOR to purchase tax exempt building materials for a high impact business or for a business located in an Enterprise Zone or River Edge Redevelopment Zone and your certificate was valid at any time during calendar year. 35 ILCS 1201q A purchaser shall not. Form EZ-1 Building Materials Exemption Certification contains all necessary information and will.

17 Lovely Florida Tax Exempt Certificate

Sales And Use Tax Regulations Article 7

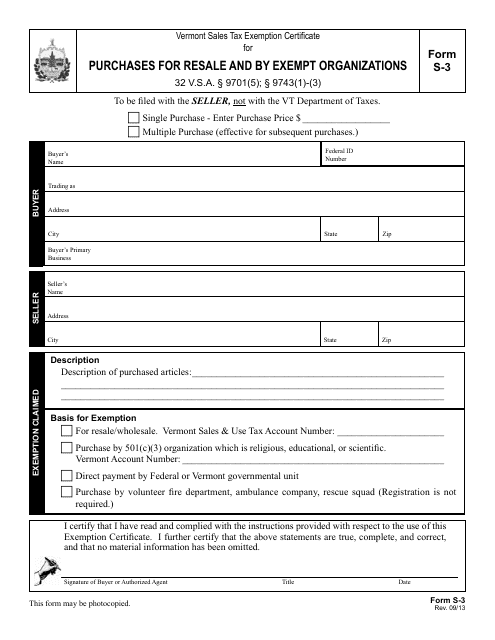

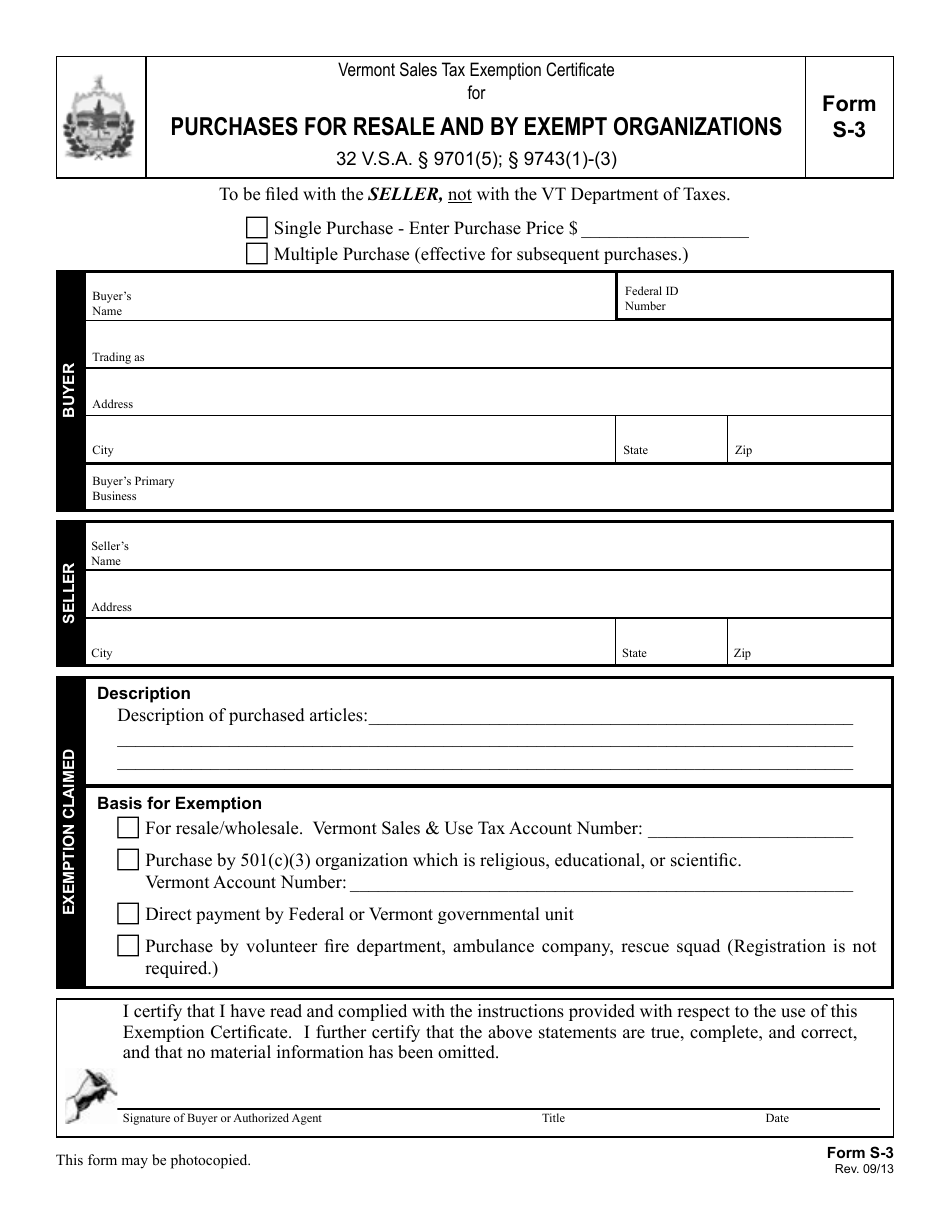

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

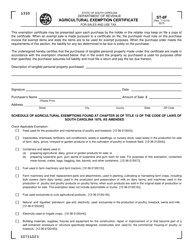

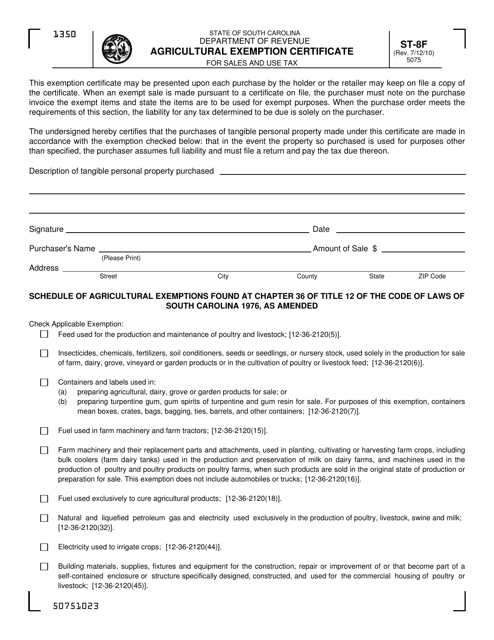

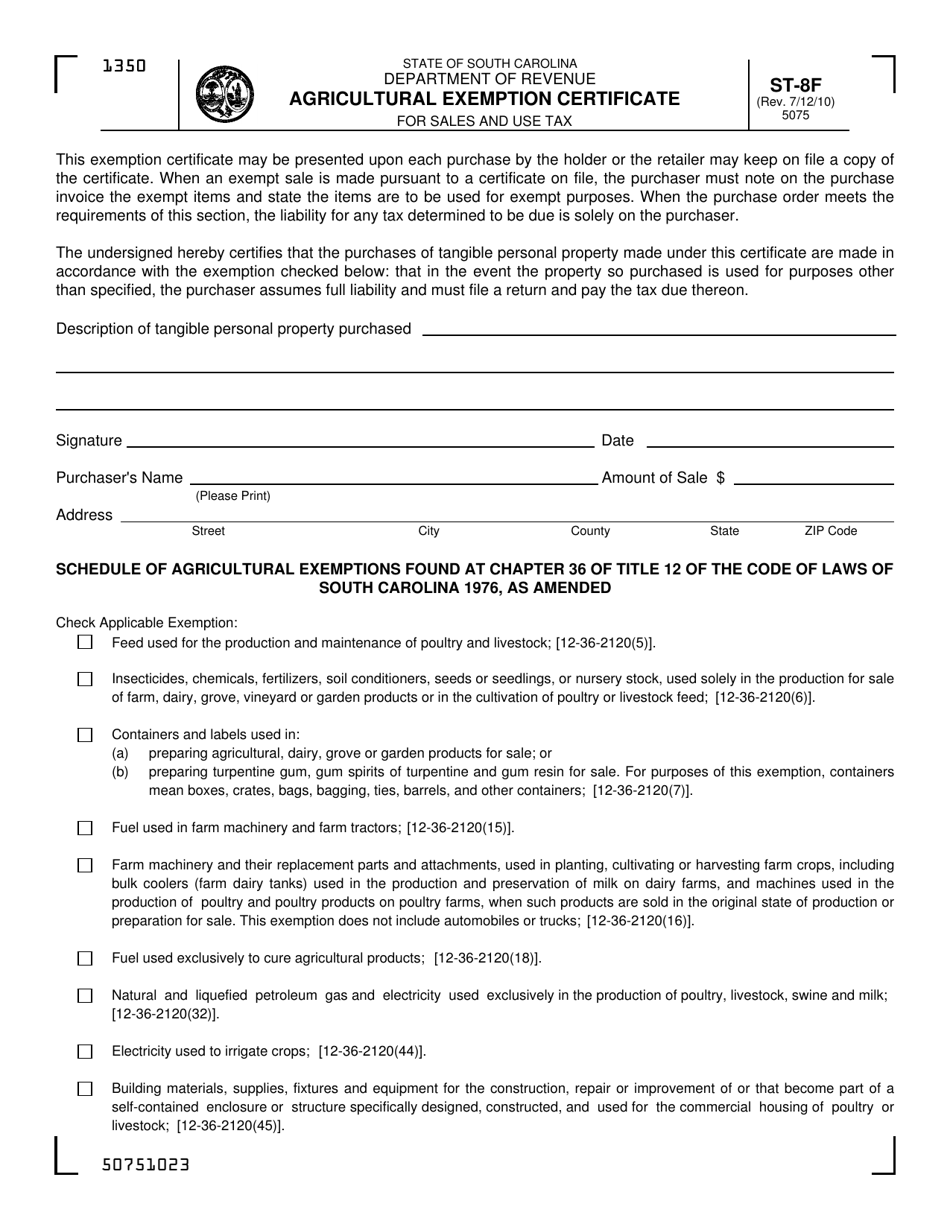

Download Instructions For Form St 8f Agricultural Exemption Certificate For Sales And Use Tax Pdf Templateroller

Sales Tax Exemption For Building Materials Used In State Construction Projects

Https Www2 Illinois Gov Rev Research Legalinformation Regs Documents Part130 130 1951 Pdf

Download Instructions For Form St 8f Agricultural Exemption Certificate For Sales And Use Tax Pdf Templateroller

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

17 Lovely Florida Tax Exempt Certificate

Http Www Zillionforms Com 2003 P28396 Pdf

Https Www Ocnyida Com Wp Content Uploads Sales Tax Exemption Extension Package Extension 2018 Pdf

Https Www2 Illinois Gov Rev Research Legalinformation Regs Documents Part130 130 1950 Pdf

Download Instructions For Form St 8f Agricultural Exemption Certificate For Sales And Use Tax Pdf Templateroller

How To Get A Resale Certificate In Texas Startingyourbusiness Com

State Of Illinois Contractor S Certificate For Exempt Purchases Fill Online Printable Fillable Blank Pdffiller

Komentar

Posting Komentar